Wednesday, June 28, 2006

Strangers with Fanta

I guess the basic lessons from childhood still apply, even when you are 31, don't accept candy (or soft drinks) from strangers.

The US Military is Not the Death Star

The key Star Wars clip:

Tarkin: The Imperial Senate will no longer be of any concern to us. I have just received word that the Emperor has dissolved the council permanently. The last remnants of the Old Republic have been swept away.Yglesias's main argument:

Tagge: But that's impossible. How will the Emperor maintain control without the bureaucracy?

Tarkin: The regional governors now have direct control over their territories. Fear will keep the local systems in line. Fear of this battle station.

What Tarkin's talking about here is a leading power -- the Empire -- trying to do away with the former constitutional order ("the last remnants of the Old Republic") in order to create a hegemonic one (Palpatine Unbound, as it were). Tagge is skeptical that this will work -- the political processes may be cumbersome, but they're actually necessary to maintain the system's stability. It would actually be even more cumbersome for the center to be constantly trying to impose its will on everyone without the assistance of the bureaucracy. Tarkin's counterproposal is that the development of the Death Star has changed the situation -- use it once on Alderaan to make an example of them, and in the future fear will keep the local systems in line.Of course, the potential logical flaw in this plan was immediately pointed out by Princess Leia:

And I think it's fairly clear that something of this sort was motivating the Bush administration in 2002-2003. The key decisionmakers took the view that technological developments (the "revolution in military affairs") had radically enhanced America's ability to overthrow foreign governments. Rather than simply keep this power in our back pocket for use when circumstances clearly warranted it (as in Afghanistan) there was a palpable desire to make an example out of Iraq to send a message.

The more you tighten your grip, Tarkin, the more star systems will slip through your fingers.When you try to bully people around, you inevitably piss them off, and more people choose to fight back. And, today, more so than in the past, one needn't have a big army to fight back. Individuals or small groups can fight back on their own through terrorist actions. How the war hawks didn't put this basic intuition together is beyond me.

As I've argued before, the best way I can see to fight terrorism is to focus on reducing demand not supply.

Tuesday, June 27, 2006

Doing Good

Monday, June 26, 2006

Social Market Failure?

If you get sick, stressed or just plain sad, you are going to want the sort of friend you can rely on. Maybe you'll be able to convert an acquaintance into a soul mate when you discover you need one. But this just-in-time approach to emotional crises isn't always going to work. Look at the way the slow decline of friendship has been mirrored by the rise of emotional problems. Over the past half-century, the prevalence of unipolar depression in affluent countries has jumped tenfold.He suggests that a gas tax might offset some of this problem by encouraging people to car pool (and presumably become friends with people as a result). Greg Mankiw fails to see the externality that needs to be corrected by such an intervention. While I also am not convinced that Americans are suffering from lack of friendships (or screwing themselves in the way Mallaby argues), I do think such a policy may actually help solve a different market failure -- the loss in aggregate social capital associated with the decline in connections among neighbors (although I have no idea if it is actually an efficient way to do this).

People's myopia on friendship is like their myopia on saving. They know that jobs are insecure, that a health problem can cause bankruptcy, that retirement is fabulously expensive; but the household savings rate has fallen below zero. Equally, people know that spouses aren't immortal and that divorce is common. But nearly one in 10 -- a much higher share than in 1985 -- reports that their husband or wife is the only person they confide in.

As I have written previously, I think Robert Putnam's worry about declining social connections among neighbors may be warranted:

So when developing a list of all the benefits of imposing a gas tax, one may be able to include a small additional benefit from any potential positive social externalities stemming from the increase in social investments among carpoolers from the same neighborhoods or communities.... in a number of contexts, market institutions have replaced social institutions substantially changing the returns to many forms of social investment and thus the composition of social capital. Such changes are clearly apparent in individuals' neighborhoods. Today, people rely on their neighbors for a smaller set of favors, and thus people are less inclined to "grin and bear" socializing with the random people who happen to live nearby. Instead, they choose to socialize with people who they know they like and who, because they have a great deal of shared interests, will involve them in very enjoyable (high return) activities and experiences.

These changes don't imply that individuals' stocks of social capital are smaller. People are likely to (and do) spend as much or more time engaged in social activities as they used to. They are likely to have as many or more social ties then they used to. However, who they are tied to, what ties them together, and the social skills necessary to make and maintain useful social ties have probably changed. Specifically, we have fewer ties to those who randomly share the same space. Thus Putnam may be right to worry. Many problems require collective action among neighbors and the coordination necessary to solve these issues is hindered by an absence of social ties among neighbors. Specifically without norms of trust and reciprocity people are unwilling to compromise, skeptical of others motives, and lacking familiarity with certain social skills and manners that help govern the process.

Inequality

First, economists (and the population in general) disagree strongly about where we should be. That is, we do not have a concensus view on what the distribution of income should look like. While this is typically viewed as a philosophical question, economists can help guide this discussion by providing the relevent descriptive statistics and, more importantly, by helping people understand the causes and consequences of inequality. E.g., is high inequality the result of "unnatural advantages" or "dumb luck" or does it reflect returns to desirable efforts? Do differences in relative status affect behavior? Does high inequality increase social tension and negative (and costly) expressions of that (like crime, rioting, or political unrest)? Does high inequality affect mobility?

Of course, even the simple task of describing the current distribution presents challenges because it is not clear what we should be measuring and targeting. We typically use the distribution of annual earnings as a crude proxy, but this may not measure what people really care about (which in the US traditionally is access to opportunity and mobility). (For more details, check out this document which I wrote awhile back, but did not post. It describes both the basic facts about inequality in the US and the difficulties associated with measuring it.)

Finally, even if we had clear ideas about about where we are currently and where we would like to be, there would be intense debate about how to bridge the gap. Particularly given political constraints, how to best achieve the desired amount of redistribution is frought with challenges -- especially given that a non-trivial fraction of the population might reject any system of ex-post transfers as immoral.

Friday, June 23, 2006

Are Americans Dangerously Isolated?

A quarter of Americans say they have no one with whom they can discuss personal troubles, more than double the number who were similarly isolated in 1985. Overall, the number of people Americans have in their closest circle of confidants has dropped from around three to about two.These results are startling. One of the authors is even quoted arguing that lack of social ties were responsible for people being left behind in New Orleans to face Katrina.

While these results are certainly accurate (the GSS is a high quality survey), I am not sure I interpret them in the same way the authors do -- i.e., that this reflects greater isolation from other people. As I have discussed previously, the long term trends in the costs and benefits of social interactions move in a variety of directions leading to no clear prediction of greater isolation. If I have a prediction, I guess it is adequately summed up by this:

People are likely to (and do) spend as much or more time engaged in social activities as they used to. They are likely to have as many or more social ties then they used to. However, who they are tied to, what ties them together, and the social skills necessary to make and maintain useful social ties have probably changed.Indeed, this interesting paper from the Pew Internet and American Life Project, takes a much broader view of core ties ("people whom Americans' turn to discuss important matters, with whom they are in frequent contact, and from whom they seek help") and significant ties (weaker then core ties, but more than acquaintances) and finds that the people have an average 23 core ties and an additional 27 significant ties. Personal introspection about my own social network and those of other people I know suggests that these numbers are not crazy. While the study lacks comparison data for a previous period, even if Americans have fewer core and significant ties than they used to, I find it hard to look at these numbers and conclude that Americans are extremely isolated.

Still, should we be concerned by the decline in propensity for people to have confidants? I am not yet concerned because it is not clear that the evidence presented reflects a real trend. The specific question asked in the GSS in 1985 and 2004 is this, "From time to time, most people discuss important matters with other people. Looking back over the last six months—who are the people with whom you discussed matters important to you?" There are several ways to interpret changes in the distribution of responses to this question.

First, one could observe the fact that respondents list fewer confidants and that 25 percent of people list no one as a confidant and infer, as the authors do, that people have no friends -- they are sad and alone. Advocates of this view, essentially make supply argument. Lurking in their argument is an assumption that demand for confidant services is constant, and the lack of confidants stems from supply problems. Somehow the price of connecting with other people has gone up, so people have fewer confidants and are more isolated.

However, one way for the price of confidant services to increase is for people to become less isolated. For instance, if technology increases the frequency of social contact among members of a social network, people may expect that their confidants are more likley to be tempted to reveal their secrets. While factors other than technology may drive such a change, any increase in the probability that private information will be distributed widely may reduce individual's willingness to discuss important private matters with others. Indeed, the growth in reliance on one's spouse for confidant services documented in the paper (see Table 2) may be driven by lower expectations of confidentiality outside the marriage unit.

Alternatively, one might argue that (for whatever reason) the norms of social behavior have changed and, in spite of the fact that people have a similar number of social ties, they are now less likely to "confide" in people. This may reflect either a shift in supply (social ties "charge" more for dealing with the burden of others social problems) or demand (individuals may have decided they prefer not to discuss some matters with other people).

Further, the observed trend could be explained by a fall in the price of substitutes (that are not captured by the survey). E.g., people may now choose to discuss some important matters with professional counselors or in anonymous internet discussions (instead of with friends and family). If people are also unwilling to disclose these connections or if they simply don't think of these connections in this context, then the data my under-report people's ability to confide in other humans. The fact that the proportion of people discussing important matters with advisors fell (in spite of growth in the use of mental health professionals) and the proportion having discussions with "other" (the only place that seemed likely to capture discussions with relatively anonymous on-line personas) fell (in spite of the fact that many people are obviously choosing to discuss important personal matters on the internet) seems to suggest that the survey may be failing to capture how people are dealing with important personal issues in the modern environment.

Finally, you could question if, when reflecting on "matters important to you", people living in 2004 think of a different set of topics (which naturally tend to be discussed with a smaller group of people) than people living in 1984. This may reflect an actual decline in the number of really important topics or merely a decline in the number of topics people think of as important. Either way, the trend may reflect a basic decline in the demand for confidants.

Without a better sense of what this trend really means, I don’t think we can draw any firm conclusions from this paper about the state of American’s social ties (much less argue that Americans are now in some sort of increased danger).

Thursday, June 22, 2006

Minimum Wages

Economics textbooks enthuse about the virtues of a price system.

...

And yet there is a problem with markets: They are absolutely and relentlessly amoral. Labor, in a market system, is just another commodity; the wage a man or woman can command has nothing to do with how much he or she needs to make to support a family or to feel part of the broader society. Some conservatives have managed to convince themselves that this poses no moral dilemma, that whatever is, is just. And one supposes that there are still unrepentant socialists who believe that one can do away with market determination of incomes altogether.

...

Now to me, at least, the obvious question is, why take this route [imposing a living wage]? Why increase the cost of labor to employers so sharply, which-Card/Krueger notwithstanding--must pose a significant risk of pricing some workers out of the market, in order to give those workers so little extra income? Why not give them the money directly, say, via an increase in the tax credit?

One answer is political: What a shift from income supports to living wage legislation does is to move the costs of income redistribution off-budget. And this may be a smart move if you believe that America should do more for its working poor, but that if it comes down to spending money on-budget it won't. Indeed, this is a popular view among economists who favor national minimum-wage increases: They will admit to their colleagues that such increases are not the best way to help the poor, but argue that it is the only politically feasible option.

But I suspect there is another, deeper issue here--namely, that even without political constraints, advocates of a living wage would not be satisfied with any plan that relies on after-market redistribution. They don't want people to "have" a decent income, they want them to "earn" it, not be dependent on demeaning handouts. Indeed, Pollin and Luce proudly display their estimates of the increase in the share of disposable income that is earned, not granted.

In short, what the living wage is really about is not living standards, or even economics, but morality. Its advocates are basically opposed to the idea that wages are a market price--determined by supply and demand, the same as the price of apples or coal. And it is for that reason, rather than the practical details, that the broader political movement of which the demand for a living wage is the leading edge is ultimately doomed to failure: For the amorality of the market economy is part of its essence, and cannot be legislated away.

Most debates over economic policy are unproductive because people try and mix elements and assumptions from all of these points together at once or because one person will argue about morality while another will be arguing about the politics. We would be much better off if we could remain focused on one question at a time. Many economic policy debates (like those over wages, trade, the environment, ...) essentially involve 3 questions:

1) How unfair or immoral is the market outcome?

2) Can "after-market" interventions produce a fair or moral outcome? (And if not, would some other intervention work?)

2a) Is it politically feasible to achieve an "appropriate" amount of redistribution (e.g., can society get the market winners to surrender enough of their gains to fairly compensate the market losers)?

2b) Can any set of "after-market" interventions actually compensate those adversely affected by market outcomes (e.g., can any government program really compensate someone who got hosed over by the market)?

3) Is the "after-market" intervention worth it? That is, does the attempt to rectify the problem only create more problems so that in the end the benefits don't justify the costs?

When discussing economic policy one ideally would be able to articulate a clear and coherent answer on each of these questions. Unfortunately, that's easier said then done, but hopefully one would have at least have a keen awareness of the key assumptions of their own and their opponents arguments (and any empirical support for them).

Officiating

Anyway, in the later part of Simmons column today and in much of his column on Tuesday, he joins a large number of people bemoaning the quality of the officiating in the NBA. This is something he frequently comments on. He even has his own theory about how the NBA "rigs" games by sending weak officials to big games. Will Hauser's term paper on home bias in NBA refs was essentially motivated by my desire to see if the empirics back up the "Simmons Hypothesis." While I hope to finish a more complete empirical examination of the assumptions underlying the Simmons Hypothesis later this summer, let me state now that I certainly agree that NBA officials have the ability to affect the outcome of games more than officials in the NFL or major league baseball (excepting maybe the atrocious officiating in the Super Bowl).

NBA officials, however, have a trivial affect on games compared to soccer officials. Soccer officials easily sway the probabilities associated with different game outcomes more than any other officials. The most dramatic way they do this is by awarding penalty kicks. Just the morning, in the wake of the highly dubious penalty kick awarded to Ghana, the probability of a Ghana victory (as reflected in the price of "Ghana to win" contracts at Tradesports) jumped from 30 percent to 70 percent. Lest you think that this is largely driven by Appiah's successful conversion of the kick, during yesterday's Portugal-Mexico match the contracts moved 20-30 points up then down (or down then up depending on which contract you examine) when O. Bravo was awarded and then missed his penalty kick.

Soccer officials also dramatically affect current (and subsequent) games by handing out yellow and red cards. E.g., when Jan Polak was sent off with his second yellow card in this morning's Italy-Czech Republic game, Italy's probability of winning jumped 10 points. It would require a more subtle analysis, but I would expect that the price in the market for future games moves similarly when the market finds out that key players will miss the next match because of red cards or accumulated yellows.

All of this is compounded by the fact that officiating in soccer is apparently arbitrary. I was watching the Argentina-Holland yawner yesterday with a friend who has probably watched more than 10 matches in her life, and she was commenting about how she still had no idea what constituted a foul much less what warranted yellow or red cards. I have to agree. I've watched hundreds more matches than she has, and I still don't get half the calls or non-calls that officials make.

This same friend also made the very good point that it seems unfair that some teams get assigned refs who hand out yellows left and right (see Mexico-Portugal which had like 9 or so) and force them to play without players in later games, while other teams get lenient refs (see England-Sweden which had only 3 yellows) and get to play the next match with all options available.

Yet, in the sport where officials likely have the biggest impact, they use the fewest number of officials. On an enormous field with 22 players, there is one referee (and two referees assistants who really only make small calls). This strikes me a silly. First, it is impossible for one person to be in position to make calls on every play. The ball travels too far, too fast, and soccer players are conditioned to take dives (precisely because the one referee is seldom in position to see what really happened). Second, having one official with an enormous amount of potential influence on the game makes soccer one of the easiest sports to fix. Gamblers only need to pay off only one guy to substantially slant the odds in their favor. In other sports, to get the same change in odds, gamblers would need to get several players or officials on board.

All in all, while I enjoy the World Cup, I am getting pretty annoyed with the officiating, and my odds of watching in the future are falling daily. It seems like a waste of time and energy to watch a game that is too frequently decided by some old dude in a yellow jersey. Oh and lest people think that I am just bitter because the US got totally hosed by the officials in the last two games, the US is not yet good enough for me to get too emotionally attached to their results. I find them extremely frustrating to watch because they make too many silly mistakes and seem incapable of putting much pressure on goal against good opponents. And based on their play in the group stage, it is hard to argue that they deserved to advance regardless of officiating.

A troublesome trend?

Middle-class neighborhoods ... are losing ground in cities across the country, shrinking at more than twice the rate of the middle class itself.

In their place, poor and rich neighborhoods are both on the rise, as cities and suburbs have become increasingly segregated by income, according to a Brookings Institution study released today. It found that as a share of all urban and suburban neighborhoods, middle-income neighborhoods in the nation's 100 largest metro areas have declined from 58 percent in 1970 to 41 percent in 2000.

It is hard for me to see how this trend could be seen as a good thing. While we still have a lot to learn about neighborhood effects, it is hard for me to imagine that income segregation does not further reduce the set of opportunities available to those living in "poor" neighborhoods making it even harder for people to move from poortown to richville.

Update: Tony V. comments on John Edwards plan for more housing vouchers. If we are concerned about growing income segregation, housing vouchers are a potentially effective way of offsetting the trend. But, as Tony V. notes, the gains would have to be clearly balanced against the costs.

Wednesday, June 21, 2006

NYC Social Norms and Conventions

Here's the section on the newest mainstream technology, ipods (which I thought was reasonable):

The Four Levels of iPod Interaction

Whom you do and don’t have to unplug for.

LEVEL ONE -- Continue at full blast. Consider increasing the vigor of your head-nodding and/or humming.

• Guys passing out bargain-electronics-store flyers.

• Idealistic-looking whippersnappers holding clipboards.

• Scientologists.

LEVEL ONE AND A HALF -- Subtly turn down volume.

• People in the elevator you don’t know.

• Someone attractive who sits down next to you on the train while you are listening to the Goo Goo Dolls.

LEVEL TWO -- Make a big show of pressing PAUSE.

• Anyone who approaches you while you’re working out.

• Non-panhandlers on the subway (may be helpfully pointing out that your bag is open, may be distracting you in a Gangs of New York–style pickpocket ruse).

• Co-workers you hate.

• Friends.

• Your parents, if you’re a teenager.

LEVEL THREE -- Remove headphones, toss them jauntily over shoulder.

• People in the elevator you know.

• Anyone taking your money or instructions about how to prepare your food.

• Co-workers you don’t hate.

• Your parents, if you’re an adult.

• Police officers.

LEVEL FOUR -- Completely remove and enclose in nearest pocket/bag/ purse.

• Co-workers who could have you fired in less than an hour.

• Anyone who’s crying.

• Police officers standing next to someone who’s pointing at you and saying, “That’s him!”

* I am not sure I buy the Reader's Digest ranking. Here's what they reportedly did:

The Big Apple scored 80 per cent in a series of tests, including dropping papers in a street in a busy area, seeing how long it took for someone to help, noting whether doors were held open and if shop assistants said thank you after making a sale.I have three big questions about their approach. First, in each city, how big was their sample? Second, were the journalists conducting the experiments locals or were they all Americans (and thus obvious outsiders in many of the contexts)? Third (and most important), would everyone agree that a clear "proper" response exists for the situations examined regardless of cultural background? As discussed in class, norms and conventions vary a great deal across space. As such, it is kind of silly to take local social customs, see if others have the same customs, and then call them rude if they don't.

Reader's Digest magazine carried out the tests by sending journalists to cities in 35 countries.

Tuesday, June 20, 2006

Something's Not Right

Am I wrong to believe that demand should have risen by more than this? If not, why has supply not risen to meet demand (or why has demand not risen to the levels I imagine)? The article linked to above suggests that security restrictions are keeping people from these jobs. While this surely could explain some of a potential supply shortfall, in 5 years presumably one can produce a large number of Arabic speakers.

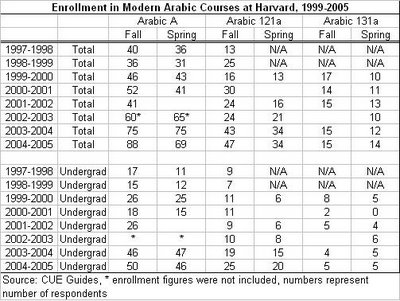

Indeed, (at least at the undergraduate level) it seems like 9/11, etc. dramatically increased the number of students enrolled in Arabic (at least at Harvard). Enrollment in beginning and intermediate Arabic courses (particularly among undergraduates) has more than doubled since the pre-9/11 era. Oddly, though, enrollment in advanced Arabic is essentially unchanged in the period.

So why has the State department only increased its employment of full-time Arabic speakers by 15%? (And if I recall correctly, the State Department isn't the only one with a potential problem. I seem to remember something about the NSA being way behind in translating all their phone recordings, so there seems to be an actual shortage.) Is the government not offering a high enough wage to eliminate the shortage? If so, why? This seems like important human capital for the government to have right now.

Monday, June 19, 2006

My friend Dave ...

Over the last few days, I’ve written a couple of letters to my wonderful wife D, but I haven’t had the chance to send them, so they've been sitting on the table in my hotel. This evening when I returned to my room after work, I went to get out my computer and found – together with the two letters I had written – another letter, written in an unfamiliar script!

Click the link to read excerpts of the mystery letter. (Also, while you are over there, check out Dave's other interesting posts from his trip to Uganda.)

Every Economist Should Agree?

Anyhow, KNZN raises another interesting point. How is means testing different from tax increases?

Politically, "getting the rich off welfare" may be an easier sell with both parties than "raising taxes." And there may be some substantive sense in which decreasing the amount of money that passes through government programs constitutes "reducing the size of government." But as far as economics goes, this proposal looks like a tax increase, walks like a tax increase, and quacks like a tax increase.Greg Mankiw elaborates on this point.

A return to happiness

One on why parents think their kids make them happy when most empirical work shows that kids make parents unhappier on average:

Studies reveal that most married couples start out happy and then become progressively less satisfied over the course of their lives, becoming especially disconsolate when their children are in diapers and in adolescence, and returning to their initial levels of happiness only after their children have had the decency to grow up and go away. When the popular press invented a malady called “empty-nest syndrome,” it failed to mention that its primary symptom is a marked increase in smiling.

Psychologists have measured how people feel as they go about their daily activities, and have found that people are less happy when they are interacting with their children than when they are eating, exercising, shopping or watching television. Indeed, an act of parenting makes most people about as happy as an act of housework. Economists have modeled the impact of many variables on people’s overall happiness and have consistently found that children have only a small impact. A small negative impact.

Another on variety (which returns to some of our earlier discussions):

I moved to Massachusetts from Texas about a decade ago, and the New Englanders who ask me this question are surprised to learn that anyone actually eats raw jalapenos, and much less for breakfast. But what surprises them most isn’t what I eat, but that I eat the same thing every Sunday. Jalapenos may be the spice of Texas, but don’t I know that variety is the spice of life?

Of course I do. But I also know that variety has costs. First, variety requires choice and choice requires time, and I’d rather spend my time writing a book or tickling my granddaughter than deciding what to eat every Sunday morning. I eat the same breakfast every Sunday for the same reason that I own 15 pairs of cargo pants in just two colors. We should only want variety among things that we enjoy thinking about, and I just don’t get much pleasure out of thinking about my breakfast or my trousers.

The final column discusses biases:

And yet, if decision-makers are more biased than they realize, they are less biased than the rest of us suspect. Research shows that while people underestimate the influence of self-interest on their own judgments and decisions, they overestimate its influence on others.

In light of our long discussions of belief formation and differences in beliefs across people, I particularly liked this:

Also, here is Professor Gilbert on the psychology of probability estimation (not from his blog). I've always found it interesting how willing people are to flip out over low-probability events. Local news is basically devoted to this topic, "Your bedsheets are going to kill you. Find out how at 11." (I loved a SNL spoof of local news (with Jerry Seinfeld) which was just a series of teasers about how common items or activities were going to kill you.)...By uncritically accepting evidence when it pleases us, and insisting on more when it doesn’t, we subtly tip the scales in our favor.

Friday, June 16, 2006

Cool

I Doubt It

I just feel like the editors they don’t realize that there’s not just one magazine—there’s other magazines and they’re all paying to get a story.

Somehow, I doubt that tabloid editors are unaware of their competition.

Ultimately, I think what Britney really believes that if the editors realized that there were so many photographers following her, they would back off. This belief requires that she assume that tabloid editors have some threshold for how much cost they're willing to impose on celebs, but they only account for the costs they directly impose. Somehow, I doubt this is right either (if for no other reason that I thought that most paparazzi were freelance and thus not directly employed by the editors).

Thursday, June 15, 2006

Meaningless Statistics

Anyhow, rule number three is:

3.No naked numbers. Don’t report numbers by themselves. Numbers have meaning only in context. And context is almost always impossible without explicit comparisons to other numbers. How does this number compare to other cities, other states, other countries, other eras? How does this number compare to total spending, spending on necessities, spending on luxuries, spending on other kinds of goods?

I point this out because Tyler Cowen is pimping reporting of a McKinsey study in the FT stating that Sweden's "real" unemployment rate is 15% (the additional 10 percent come from including those who want to or could work). Here's the key fear-mongering by the FT reporter, "The numbers cast a pall over Sweden's international reputation as a thriving welfare state with low unemployment..." Of course no where does the reporter discuss what the "real" unemployment rates in other countries would be if similar calculations were performed. Colman posts a diary at DailyKos arguing that a similar calculation for the US would produce a real unemployment rate of 13.3%. I haven't looked at the data myself, so I have no idea if his number is correct. Colman's instinct, however, is correct. Without a comparison, Sweden's "real" unemployment rate of 15% is completely meaningless.

Tuesday, June 13, 2006

Games Children Play

Because of AIDS, much of Right To Play's effort in Africa is directed toward HIV awareness. Coaches teach the children, who range in age from 10 to 16, about AIDS through a series of games.

In one, the children gather in a circle and a coach tries, unsuccessfully, to push some over. Then, they stand on one leg and he does it again. Children laugh as they topple over easily. This, the coaches tell them, shows the effect of HIV on the body: It's like making the body's immune system stand on one leg.

In another game, a form of tag, the children chase each other, only in this version you aren't "it" when tagged if you can name an effective way to protect yourself from HIV. "Abstinence!" shouts one. "Be faithful to your partner," says another. "Condoms!" yells a third.

The rest of Jim Caple's article on Right to Play's work in Zambia is worth a read.

Monday, June 12, 2006

Interesting discovery

This Ain't No Jibber Jabber

The internet (particularly stuff like YouTube) is amazing.

(h/t Megan)

Thursday, June 08, 2006

Pumping Gas, My Final Words

To recap:

Bryce round 1

Tony V. round 1

Bryce round 2

Tony V. round 2

In his round 2, Tony V. asks, "what is the relevant market failure here?" He doesn't understand what produces the market failure, and thus can't believe that it exists. To this I respond, "how is the failure of a profitable market to exist in most of the country not sufficient evidence for market failure?" In many places, people cannot easily pay someone to pump gas for them even though collectively they are willing to pay more than enough to compensate those necessary to provide the service. They cannot do this because the owners of the gas stations do not allow this market to develop. Ultimately, I argue in this post that this occurs because the affected parties are unable to coordinate and "bribe" the owner (although at least part of this failure may be an entrepreneurial failure and not a failure of the market (unless we blame the market for failing to produce such an entrepreneur).

There are two important components to my argument. First, I argue that (in the absence of other considerations like convenience store bundling) this market should exist much more widely than it does currently. That is, the total value to consumers of this service exceeds the total cost to service providers (i.e., S>0 in the model below). My guess is that at any moderately busy gas station (particularly one in a location prone to inclement weather or in a moderately upscale area) an individual could easily earn more than minimum wage charging 25 cents per car to pump gas. In actuality, my belief is that many people would gladly pay a dollar (particularly if we called it a tip). At many hotels, airports, and train stations, people tip bellhops or skycaps a dollar per bag (and frequently more) to carry/watch bags. We tip waiters, baristas, cab drivers, … above the amount of their compensation that was already incorporated into the price. Now, I certainly understand that some of these are just random conventions and maybe the forces of convention have decided that paying someone to pump gas is unnecessary or unseemly (enough so S=0 in nearly all cases), but I find that implausible. Pumping gas and washing windows is dirty work (in that your hands and clothes can actually get dirty), and many people gladly pay others to do their dirty work.

Second, I argue that the economy as a whole is worse off when this market is not allowed to develop. That is, I argue that the marginal gain to owners from preventing people from providing this service (which comes entirely from the gain in profits from people who would not have purchased other (high profit-margin) goods and services if they weren’t forced to get out of their car) is not larger than what is lost to the would be consumers and providers of mini-serve and the would be recipients of the money spent by those whose behavior changed when they were forced to get out of their cars.

Now, this is a situation with clearly defined property rights (the owners of the service stations have the right to allow or not allow others to pump gas in exchange for money on their property). Thus the Coase Theorem indicates that we should be able to reach the efficient outcome. The three groups who benefit from allowing mini-serve (consumers of mini-serve, providers of mini-serve, and whoever loses profits from people whose choices change when they are forced to get out of their cars) should band together and bribe the owner fully compensating him/her for the lost convenience store profit and leaving everyone better off.

The problem in this case (and in most cases where the Coase Theorem fails) is coordinating that transaction. The obvious hurdle is identifying and involving the affected alternative suppliers. These people probably have no idea that they would have benefited by X if person A had not gotten out of their car back at the gas station. If they don’t realize they’ve been affected, involving them in the bribe transaction is clearly difficult. Further, given the high profit margins on convenience store items (while gas accounts for 66.5 percent of revenue it accounts for only 27.5 percent of gross profits), this group may be necessary to achieve the efficient outcome. (Technically, I guess I also need to account for the counter bribe from the people who ultimately get the dollars that would get spent buying gas pumping services in the model as well.)

Setting that group aside, if the surplus from just the market for pumping gas is large enough, it might be possible to improve efficiency simply by doing a better job of extracting the surplus from consumers (and to a lesser extent providers). In the previous model, I assumed that the sellers of gas pumping services could perfectly price discriminate in order to capture all of consumer surplus. The failure to allow service came if owners couldn’t extract enough of that surplus from the servers (i.e. b was small). In reality, extracting surplus from consumers is much harder than extracting surplus from the servers. It may be that the failure of this market to develop stems from difficulty price discriminating.

Typically, at mini-serve in Oregon and New Jersey and full-serve everywhere, the price of service is added to the per gallon price of gasoline. This single price allows consumers to keep a lot of their consumer surplus. It is certainly plausible that sufficiently compensating both service providers and owners requires extracting more of consumer surplus than is possible at a single price. As such, the failure may be entrepreneurial (i.e., the failure is figuring out how to do this).

I think the timing is ripe for someone to enter the market and supply gas pumping and window washing services and solve this problem. After 30 years many people (outside of Oregon and New Jersey) are sufficiently conditioned to combine gas purchases with sugar, fat, and nicotine purchases that I expect losses from people choosing to stay in their car are falling. Further, as pay at the pump technology spreads the number of self-serve customers buying convenience items may be falling. These two forces lower the expected amount an entrepreneur needs to pay an owner in order to supply service. In order to maximize the likelihood of success, I think the market should be organized similar to a strip club. Service providers pump gas, wash windows, and do whatever else (ok maybe putting “whatever else” in close proximity to a strip club reference wasn’t a good idea, but you get the picture) in exchange for tips. Maybe one would charge a small flat fee for the service, but most of the extraction of consumer surplus would come from tips. The owner of the station then charges a “uniform fee” in order to extract enough rents to compensate for lost revenues. If this uniform fee not so large that people are deterred from taking the job, everyone is better off. Consumers keep some surplus, service providers probably make more than minimum wage, and owners are happy.

Wednesday, June 07, 2006

More Gas Pumping

This is silly. One of the first things we teach undergraduates in economics is that producers following their self-interest do not always produce the efficient market outcome. We talk about how monopolies produce deadweight losses by choosing not to produce goods that consumers are willing to pay more then it costs them to provide.

Something similar is happening with pumping gas. A service which in many (though probably not all) cases could be produced profitably is not being produced. This represents a loss to the economy. Losses to the economy are bad. We want to understand where they come from, and we want to make sure that when we observe them the factors which lead to these losses are more than making up for them by increasing total surplus in some other way.

In brief, what I argued previously is that it is not obvious to me that the marginal gains from not offering full service offset the losses.

Let do this more slowly and try and very clearly identify the marginal benefits and costs to the economy.

Start by examining a single market with one gas station that has a convenience store in an area where self-service is allowed. In order to help clarify the effects on all of the affected parties, assume that the service of pumping gas (and washing windows, etc.) is not directly provided by the station owner, but rather it is provided by independent contractors who pay a fee to owners in exchange for being allowed to work their lot. Finally, assume that these independent contractors and convenience store operators are able to perfectly price discriminate and capture all of consumer’s willingness to pay for these services. (This assumption is not necessary, but it may help make the explanation simpler by concentrating the surplus from the market into fewer agents.)

So we have 3 agents and 4 choices. Owners must decide whether or not to allow the independent servers to work at their stations. Independent servers decide whether or not to provide service or pursue a different job/leisure outcome. Consumers decide whether or not to buy pumping services and whether or not to by convenience store goods/services.

We are focused primarily on the owner’s decision, so let’s start there. Owners allow independent servers if:

Vsscs + Vfscs + bS > V’sscs

Where Vsscs = total value of self-service customers convenience store purchases minus costs; Vfscs = total value of full service customers convenience store purchases minus costs, b is an element of [0, 1] and represents the fraction of the rents from providing full service the owners capture, S is value of full service customers minus the providers reservation wages (e.g., the cost of providing it), and V’ is the surplus from the convenience store when everyone is a self-service customer.

If Vsscs+Vfscs=V’sscs and b>0 and S>0, owners should allow this service to be provided. If it is not being provided it must be either:

1) S=0

2) Vfscs+bS is less than V’fscs (= V’sscs - Vsscs) (What owners can extract from full service customers is less than what they can extract from them when they are forced to be self-service customers)

Case 1 is trivial. In this case, the willingness of those who wish to buy the service does not provide enough compensation for anyone to supply the service.

Case 2 is more interesting (and is essentially what I argued in my previous post). V’fscs-Vfscs represents the maximum potential gain to the economy (this is the marginal gain in value in the convenience item market from forcing people to use self-service). Determining the effect on overall economic welfare requires addressing two questions: (1) does this gain outweigh the losses to the economy of S and (2) how much of this amount represents a gain to the economy (versus a transfer from some other entity)?

First, assume that all of V’fscs-Vfscs represents a gain to the economy. If b is sufficiently small (i.e., owners struggle to extract the rents from providers of the service), owners would choose to prohibit full service even though the whole economy loses as a result of this decision. (b less than (V’fscs-Vfscs)/S) implies V’fscs-Vfscs greater than bS even though S is greater than V’fscs-Vfscs).

Second, even if b=1, V’fscs-Vfscs does not necessarily represent gains to the economy. It represents gains to the owner of the gas station. However, in the full serve state of the world, some (or even all) of this value might have accrued to some other producers (e.g., a different store). Again, if a sufficiently large fraction of these gains do not represent gains to the economy but simply transfers among different agents, then the loss of S outweighs these gains and the economy as a whole is worse off.

I set a time limit on how long I could spend writing this post, and that time is up. However, I think I have made my main point – the decision to eschew providing full service possibly imposes a net loss on the economy. This was the idea in my previous post. Certainly, I have no idea if the net gains and losses of the self-service laws are positive or negative. The point I was making was that the issue is not as simple as my economist friends made it out to me. Later, I might return and discuss what happens if people suffer from self-control problems and what happens when there is competition (e.g., why doesn’t a competitor enter the market to try and capture S), but this will have to suffice for now.

Tuesday, June 06, 2006

Self-Service Gas Stations

Yet I, and most Oregonians I know, like the self-service law. Most of my economist friends, however, flip out at the mention of this law (except the one who moved to New Jersey and quickly did a 180 on this topic). Restricting choice is bad. How dare Oregon and New Jersey force people to pay higher gas prices for no good reason! If people prefer full-service let them pay for it.

Typically, I would say their logic is fine; however, observation indicates that full service is extremely hard to find in states which allow self-service. I asked a friend of mine who does accounting for a company that runs 40 or so gas stations in Oregon how much the self-service law adds to the price of gas in Oregon. At the stations run by his employer, he estimates that it adds 1 to 2 cents per gallon (depending on how busy the station is). I find it very hard to believe that there are not enough customers to support more full service options. Are most people really unwilling to pay 15 cents to avoid getting out of their car (particularly when it is hot, cold, raining, etc) and getting their hands dirty?

But if people are willing to pay for the service, why don’t more entrepreneurs provide the service? If there really is enough demand for full service to cover the costs, it only makes sense to not offer full service if the proprietor can make more money by not offering it. How would this happen?

It happens because (until recently with the introduction of credit card machines in gas pumps) people at self-service stations had to get out of their cars and go pay an attendant. This allowed the station proprietor to sell them other stuff at the same time. Given the high profit margins on impulse/convenience purchases, it only takes a small fraction of people succumbing to the allure of convenient sugar, fat, nicotine, and gambling to make it worthwhile to force everyone to get out of their cars. Thus, in the absence of a self-service law, full service disappears because the profits from the combination of self-service and convenience purchases dwarf the profit from providing full-service at a price most people are willing to pay.

The evidence suggests this is likely correct. At gas stations with convenience stores, gasoline sales account for only 54 percent of revenues, so it seems very plausible that stations make a lot of money by forcing people to get out of their cars. Further, New Jersey and Oregon (where most people don't have to get out of their cars to buy gas) have the lowest percentages of gas stations with convenience stores (18 and 30 percent respectively, compared to the US average of 62 percent). (1997 Economic Census).

In light of this, the welfare consequences of the law are not as straightforward as my economist friends argued. In the absence of the self-service law two types of people are worse off. First, those who would be willing to purchase full service at MC (or close to it) no longer have this option. Second, people with self-control problems are now faced with an additional temptation to buy stuff that they prefer not to buy. The losses to these individuals need to be weighed against the gains to those who prefer self-service. While I don’t know if the gains from the law outweigh the losses (or if there is some alternative which would improve welfare for all groups -- e.g., mandate the stations of certain size provide full service or subsidize full service), the debate is not nearly as simply or as obvious as my economist friends argued.

Monday, June 05, 2006

Estate Tax

1) The estate tax imposes economic burdens (depends on how you model the bequests).

2) The economic burdens are bourne only by the rich (depends on if costs bourne by donors, heirs, or economy in form of lower K-L ratios and lower real wages).

3) Because it is a tax on the rich, it should be retained at all costs (while it is the most progressive tax available, this depends on weighing costs and benefits which ultimately requires value judgments).

4) The estate tax reduces savings (lots of rhetoric, but few facts on this topic)

5) The estate tax imposes undue burdens on family owned business and farms (no farm has gone out of business because of estate tax, most family owned business and farms not subject to the tax, and if this is a problem for those very few that are it is easily to adjust the tax to avoid these issues)

6) The estate tax is easy to avoid and evade, especially by the wealthiest families (this one is tough to summarize, but it doesn't look like this is true).

7) The cost of administering the tax are roughly equal to the revenue raised (doesn't appear to be true).

8) The estate tax raises charitable contributions (seems likely).

9) The estate tax is a death tax, and death should not be a taxable event (clearly just rhetoric -- they pretty much claim this is just stupid).

10) The wealth in estates has already been taxed once and sometimes more than that (semi-true, but so what? And much of wealth taxed has not been taxed previously.)

That is a very dirty summary. If you think you will ever discuss this issue, I recommend reading the whole thing.

Update -- Tony V nicely summarizes the current debate among economists over at Econball. As usual, people aren't debating the same issue. One group opposes repealing the specifics of the estate tax proposal because it raises the defict, while cutting social programs. The other group supports the repeal because they argue it is economically inefficient. I agree with Tony V, I would be happy to repeal the estate tax if it were replaced with some other revenue neutral, highly progressive tax. Given that is not the current debate, I am strongly opposed to the current bill.

Stocks and the World Cup

This paper investigates the stock market reaction to sudden changes in investor mood. Motivated by psychological evidence of a strong link between soccer outcomes and mood, we use international soccer results as our primary mood variable. We find a significant market decline after soccer losses. For example, a loss in the World Cup elimination stage leads to a next-day abnormal stock return of −49 basis points. This loss effect is stronger in smallstocks and in more important games, and is robust to methodological changes. We also document a loss effect after international cricket, rugby, and basketball games.

Friday, June 02, 2006

The Unintentional Comedy Scale Shattered?

I was skeptical. I have always been very partial to the Hasselhoff "Hooked on a Feeling" video, but at the 3:47 mark in this clip I had to concede. I was actually startled 2 times during this clip, and I spent the last minute laughing hysterically.

How You Got into Harvard?

They argue that while participation in a wide variety high school extracurriculars is correlated with college attendance, very few activities differentially affect attendance at selective institutions. Parent attendance at art museums, participation in the school paper, and school hobby clubs were correlated with attendance at selective institutions. They interpret the museum finding to suggest that maybe kids with "high brow" parents develop cultural capital which allows them to "speak the language" of elite university and thus excel in applications/interviews and get in.

I really don't know what to make of this stuff. I need to go read the full academic version of the paper and figure out more precisely what they did. My first impression, though, is that, unfortunately, the NELS data they use is unlikely to really help them illuminate the effect of activities on attendance of selective institutions. The NELS, I believe, only measures participation, and I think that, when it comes to activities, elite schools look for students who excel, not just participate. Further, if participation has an effect, I would argue that it is cumulative -- participation in lots of stuff (or stuff which cumulatively represents a wide array of interests and a fairly large time commitment) might have an effect. Thus, I would like to see if participation in more activities correlates with attendance of elite schools (although maybe they do this in the longer version). Finally, the cultural capital argument is interesting, I will likely enjoy mulling it over for the rest of the day, but I will need a lot more evidence before I am convinced.

More later, once I've processed this.

(h/t Tyler Cowen)

Thursday, June 01, 2006

Ticket Prices, Part 2

First, what has changed?

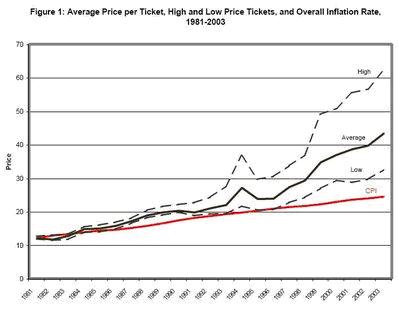

As documented in Krueger (2005), starting around 1997, concert prices started to increase faster than inflation.

Further, the price growth in concerts tickets is faster than in other similar entertainment experiences:

Krueger explores several hypotheses for the change (stronger superstar effects, cartelization (related to Clear Channel), Baumol and Bowen's disease, and Bowie theory (price rose as a result of lost revenues to file sharing). He fails to convincingly establish evidence for any, but he thinks that the lost revenue to file sharing is the most promising explanation. I, like Tony V, am not convinced.

I am surprised he doesn’t devote more effort to the composition of the “basket of goods” that comprise his average. I think fundamental changes in the composition of the rock/pop concert industry probably drive most of this increase. While Krueger computes several different price indices in an attempt to account for changes in the basket of concerts, none of his efforts account for the major changes that occurred as artists and their fans aged, as new genres developed, and as the quality of the concert experience changed.

Right now, for the sake of brevity, I am going to limit the discussion to changes in demographics. Rock/pop concerts used to be primarily produced and consumed by young people. This is no longer the case. Now, older artists with older (and richer) fans drive an enormous share of concert sales. Understanding price growth in the concert industry requires accounting for this change. I don’t think one can treat a Rolling Stones concert today the same as a Rolling Stones concert in the same venue in 1982 or 1969. The product appears roughly the same, many of the fans may be the same, but everyone is 25-40 years older. This matters because 40 years ago there were very few 50 year olds attending rock concerts.

Examining the lists of the top 20 concert draws in each of 2003, 2004, and 2005 (available here) reveals the importance of the graying of concert audiences in the market for live music. Of the artists behind the top 10 grossing concerts in this period (not adjusted for inflation), none got their start in the 1990s, and among the top 20 only Kenny Chesney and the Dixie Chicks got their start in the 1990s (and U2, Madonna, and Celine Dion are the only ones who started in the 1980s).

Geezer groups did not always produce the top grossing concerts. Among the top 19 grossing tours of 1987, 11 of the 19 first hit it big during the 1980s. The two most popular tours (U2 and Bon Jovi) were in support of their first mega-hits (“The Joshua Tree” and “Slippery When Wet”), and even the “old” groups on the list, Pink Floyd and the Grateful Dead, were touring in support of multi-platinum albums (including the Dead’s highest selling album ever).

During the 1980s, essentially no superstar gray-beards toured because rock and roll, itself, was young and their weren’t many artists who even qualified, and also because artists who might have filled that role (or something like it) had died (Elvis Presley, John Lennon), took the 80s off (Paul McCartney -- no tours between 1976-1990, the Rolling Stones – no tours between 1982-1989), or had broken up (Led Zepplin, Simon and Garfunkel).

Today, well-known groups from years ago dominate the live music scene. Look at this list of concerts that played in the LA area during the summer 0f 1999. Notice how few “current” acts there are. I could not find a similar list for a previous period, but I doubt that such a large proportion of acts targeted older audiences. (This list of all the artists performing at Des Moines, Iowa’s “Barn” from 1956 to the present gives a small glimpse of the changes.)

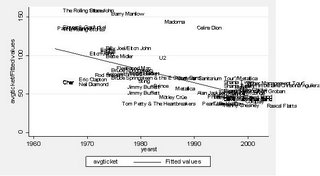

The growth in “nostalgia” acts is important because these groups charge much higher prices than other concerts. This effect is clear in the figure below which plots the average ticket price for the top 20 grossing concert tours in 2003, 2004, 2005 against the year the artist (approximately) hit the mainstream. (The raw data for the table is available here.)

Top grossing artists that have been around longer charge higher prices. These artists draw from a larger and richer fan base (because they have many more older fans then new groups). As such, the growth in the number and popularity of older artists likely contributes a great deal to the growth in average ticket prices in recent years.

Changes in the age distribution of concert attendees (stemming from increased supply of nostalgia acts) may explain not only why ticket prices have gone up in recent years, but also why they have gone up substantially more than prices for other live entertainment. I would be surprised if the audience demographics for sporting events, plays, etc. changed substantially in recent years, and I doubt strongly that any possible changes are similar to those occurring in the music business.

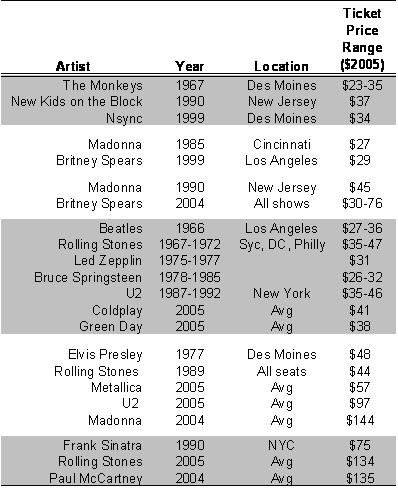

Thus, understanding ticket price changes requires looking carefully at changes in prices for similar concerts. This requires not looking at the same bands over time, but rather requires comparing the prices of groups offering a similar experience to a similar set of fans -- e.g., compare the Rolling Stones in 1972 to U2 in 1992 to Green Day today. A summary of my extremely crude attempts to do this based only on searching Lexis-Nexis for articles on concert prices and the internet for ticket stubs is presented in the table below.

Groups at their initial surge of popularity through their first 10 years or so, appear to charge roughly the same prices from the 1960s through today. E.g., The Monkeys in 1967, New Kids on the Block in 1990, and NSync in 1999, all boy bands within a year or so of their break-out hits, charge roughly the same price for their shows $35 ($2005). Britney Spears and Madonna also charged roughly the same prices at the same points in their careers. Big rock groups show more variation. Groups in their early prime in the 1970s/early 80s seem to have charged less than groups in their primes in the 1960s, late 1980s, or today. Prices among groups 20 or 40 years after breaking into the business, however, are much higher than the few quasi-comparables available. U2 and Madonna are charging more than twice what Elvis Presley and the Rolling Stones charged at similar stages in their careers, and the Stones and Paul McCartney are charging twice what Frank Sinatra charged.

While this table is far from solid evidence, it does further suggest that understanding the trends among these older artists is essential to understanding growth in average concert ticket prices.

So why are established mega-stars charging higher and higher prices? First, Krueger’s preferred explanation – artists charge higher prices to recoup lost revenue from file sharing does not seem consistent with big price increases among established, mega-groups, but not younger groups. Younger stars like Britney Spears likely suffer much larger lost revenues from file sharing than the Rolling Stones do; however, these younger stars do not appear to have increased their prices substantially over the prices charged by similar groups in the pre-internet era, but the older established groups have.

Second, I think a large fraction of the increase may stem from a fundamental change in ticket pricing. Until recently, most shows used a single price for all seats in the house. Krueger notes that in the 1980s 73 percent of concerts in arenas with more than 25,000 seats charged one price. In 2003, only 26 percent did. A 1995 article in the Washington Post ("The Road Warriors: '94 Concert Tours Set Record" 1/4/1995) suggests that price discrimination among the top tours became popular in 1994:

One major change last year involved ticket pricing. Of the Top 200 concerts, only 35 (mostly Grateful Dead and Garth Brooks shows) used the single-price system (the same price for all seats) that has long been the norm." The Stones had a three-tier system, but the emerging trend is the "Golden Circle": The Eagles got $ 100 a ticket from those who wanted to sit as close to the stage as possible; Elton John and Billy Joel got $ 85; and Pink Floyd, $ 75. For acts appealing to a younger, presumably poorer demographic, it was a different story. Green Day kept its prices at $ 10 -- which may be why the group didn't make the Top 50.

I have no idea if this author is correct and their was a big move toward price discrimination starting around 1994 among top artists, but the data I looked over suggests there may be something to this. At the very least, ticket price dispersion, if it existed, used to be pretty small, but now it can be huge. And it is growth of high end ticket prices fuels the growth in average ticket prices among the established groups.

The old uniform price has become the low price (which makes sense given the people were willing to pay that much for the same seat before). Low prices for artists like Madonna, Prince, Van Halen, David Bowie, Rod Stewart, and Aerosmith were all nearly identical to the real prices of their shows earlier in their careers. E.g., in 2004 the cheapest seats to Madonna’s tour were $48 almost exactly what they were (in real terms) for all seats on her 1990 tour ($45); however, the highest priced seats for the 2004 tour sold for $300.

Finally, why, then, are established mega-groups now willing to price discriminate? I don’t have any solid answers for this question. I think the simplest answer is, “why not?” Given that the low price is essentially the old price, they only increase their revenues. They are old and established, so they are unlikely to take a big popularity hit should they upset anyone (and since many tickets are still available at the “old” price it seems unlikely that they will upset that many people).

In sum, I think that the growth in ticket prices stems from the fact that more bands that achieved superstardom at some point in the past are still around touring and their now old and rich fans are still willing to see them (and pay higher prices because concerts are a normal good).

Subscribe to Posts [Atom]